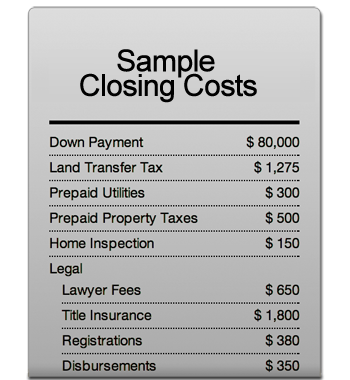

You should allow at least 1.5% of the purchase price for closing costs although I recommend approximately 2% to be on the safe side. These may be made up of the following fees:

Legal Fee and Disbursements

A lawyer will charge a fee for their professional services involved in drafting the title deed, preparing the mortgage, and conducting the various searches. The disbursements, on the other hand, are out-of-pocket expenses incurred, such as registrations, searches, supplies, etc., plus H.S.T. A typical purchase transaction for a $200,000 property with one mortgage will range between $800 to $1,200 including disbursements.

Land Transfer Tax

There is a land transfer tax that is charged on closing when the property is transferred to your name and it can vary depending on the price of the home. For a home sold in the range of $250,000-$400.000 you would multiply the Value of the home × 0.015 – $1,525 — so for a $350,000 home the tax would be $3725. A first time home buyer would be exempt from this tax, in Ontario we classify a first time home buyer as someone who has never owned property anywhere in the world.

Mortgage Insurance

Typically, lenders require mortgage loan insurance for loans made to anyone that wishes to purchase a home with less than 20% of the purchase price. The Canadian Bank Act prohibits most federally regulated lending institutions from providing mortgages without mortgage loan insurance for amounts that exceed 80% of the value of the home or purchases with less than 20% down payment.

Property Tax and Prepaid Utilities Adjustments

At the time of a sale,your lawyer must confirm that local taxes have been paid up to date. If they are, a Tax Certificate is issued, from which any adjustments can be made – usually requiring you as the buyer to compensate the seller for any prepaid taxes. If they are not up to date, the municipality requires that the seller pay them off from the proceeds of the sale. Therefore, the previous owner has prepaid property taxes or other utilities for the year, they will be credited the prepaid portion on closing.

Property Appraisal

If your lender requires an appraisal report to be completed, it will have to be done before they hand over any mortgage money. They want to be assured that the property is worth what you are either paying for it, or valuing it for, and the cost normally ranges between $175 to $285 depending upon the location and complexity of the property.

Home Inspection

A report commissioned by you, usually to verify the condition of the property prior to the “firming up” of the Real Estate transaction. The scope and detail may vary, but most reports indicate the specific problem and the cost to repair. Depending on the size and location of the property, a home inspection is around $300.

Interest Adjustment (IA)

If you arrange to make your mortgage payments monthly on the first day of the month, and your transaction closes after the first day of the month, your lender may charge you interest on closing up to the first theoretical payment date, called the Interest Adjustment Date (IAD). All mortgages are paid in arrears so if your possession date is June 1st, and you choose to pay monthly, then your first payment will be July 1st. In this example there is no Interest Adjustment payable. However, if you moved in on May 29th, with your first payment on the first of the month, your first payment would still be July 1st, but there will be a three day Interest Adjustment (from May 29th to to the “official start date” of June 1st).